The move away from paper-based to online claims reporting is an important step toward digital processes for many organisations. Mobile Data Intake (MDI) is the logical progression of digitisation, as it enables people to work comfortably and independently while staying informed on the go.

Typical claims processes, such as the precautionary reporting of incidents or the recording of risk assessment reports, are streamlined and at the same time less prone to errors. With mobile data intake, paper chaos is a thing of the past.

The key benefits that MDI offers can best be illustrated using everyday work processes in insurance management. Consider the following example depicting the First Notification of Loss (FNOL) process with and without mobile data intake.

Loss Notification without Mobile Data Intake

The local plant manager at a production site in South America was just informed by one of his employees about a defective roller. He’s responsible for providing a prompt notification of damage to the central insurance department in Germany to initiate further steps, depending on the nature and extent of the damage.

Typically, the plant manager must either manually fill out a predefined damage report form, scan it and send it as an email attachment to the internal insurance department. If an online version of the form exists, he still must manually re-enter the data from the paper form. In both cases, he must transfer photos that he has taken of the damage from his camera or mobile phone to his computer and attach them to the email or online form.

Once he submits the form, he must wait to receive a response from the insurance department with an overview of the processing status of the damage reported (e.g., within the property coverage, not insured, in processing, further information required, payment made). Thus, the plant manager has no possibility to get a timely summary of the processing status of the claims. Lack of transparency is a problem, especially in areas with frequent damage.

Another common issue is that the person reporting the incident often forgets in the “heat of the moment” to record all the information needed for the fact check (e.g., description of the damage, damage location, photos, etc.). This incomplete data leads to unnecessary communication loops and queries and slows down claims processing by the internal insurance department or the responsible service provider.

Loss Notification with Mobile Data Intake

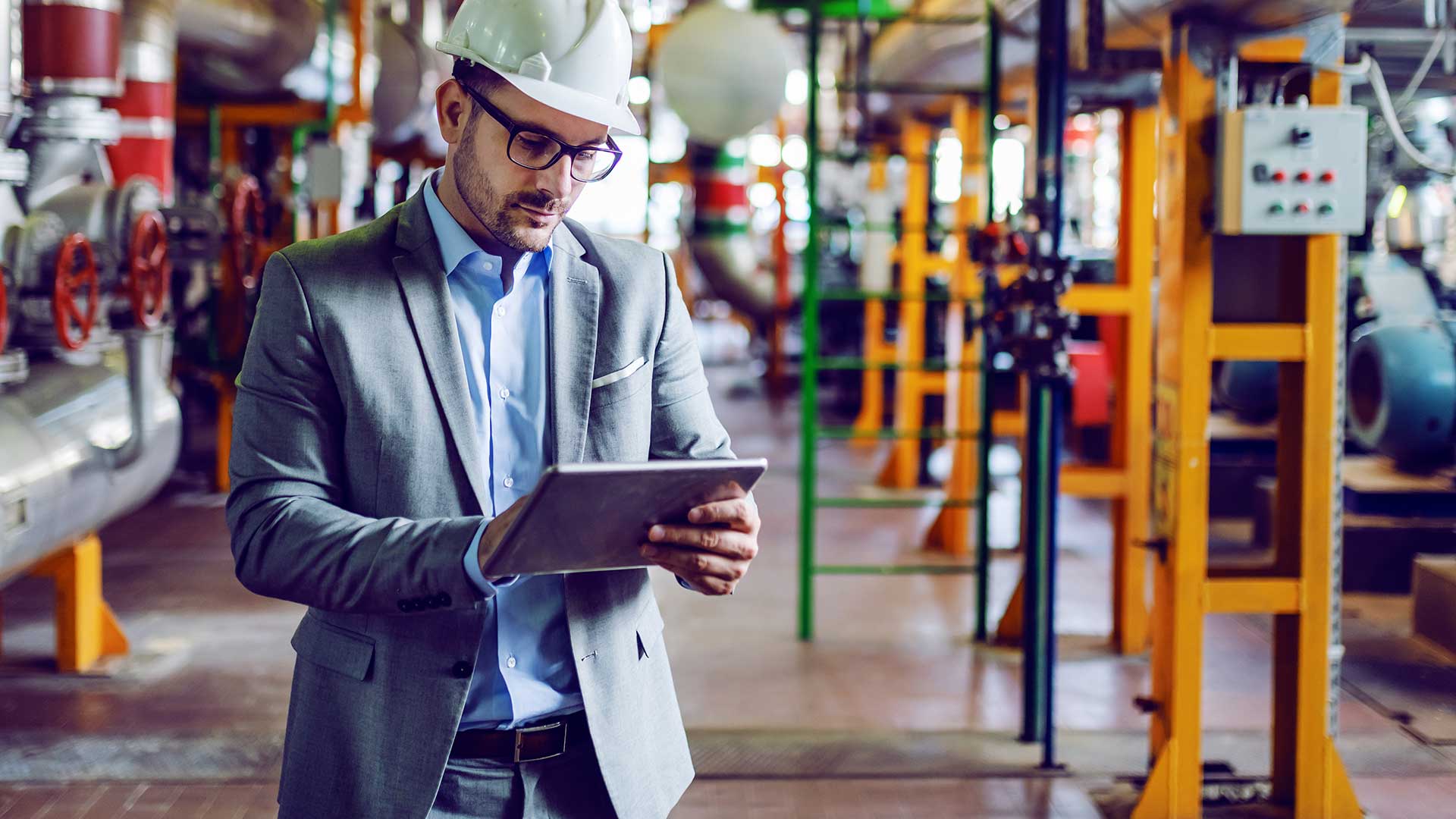

Now let’s see how mobile data intake could help the plant manager in our example scenario.

- End-to-end digital and lean processes.

Mobile data intake significantly streamlines and simplifies the outlined claims reporting process (both for the person reporting the claim and for the people processing the claim). With the right technology, a quick and straightforward process becomes possible. The plant manager can start recording the damage directly from his tablet or smartphone and does not have to rely on paper forms or documents on his desktop. (Where was the damage report form on SharePoint again? What was the URL for the online claim form again?).

- Interactive questionnaires tailored to the knowledge level of the person making the report.

A key advantage of mobile data intake is the ability to make interactive surveys. Complex branching logic ensures that the person who enters the data only has to answer the questions that are actually relevant to the specific claim being reported (e.g., if third parties were injured, additional questions about the injured person have to be answered. If a third party's vehicle was damaged, this information is also important).

- High-quality data right from the start.

In addition to improving efficiency, automation also eliminates potential sources of error in conventional data entry. The mobile intake app immediately checks whether errors were made during entry and prompts the user to correct them. Automation can prevent incorrect entries in the system due to typing errors, transposed numbers or required fields that haven’t been completed. Ensuring proper entry dramatically improves the quality and integrity of the data from the beginning.

- Everything in real time, for everyone involved.

Mobile data intake can provide immediate transparency and clarity for everyone involved in the claims process. On the one hand, the most current data is always retrieved from the connected risk and insurance management platform, and on the other hand, the data can be kept up to date in the platform itself. In the example scenario, the plant manager can see the current processing status of submitted claims at a glance on the app. This is because the data is available in the app in real time, meaning there’s no delay between the real process step and the storage of the data in the connected data management platform. This allows data to be evaluated much more precisely.

The plant manager in this scenario could certainly benefit from mobile data intake to automate tedious tasks and enhance data integrity. Mobile technology can also dramatically improve processes and outcomes for audits, risk inspections, incident reporting, and other initiatives that require data processing. Mobile data intake opens up completely new possibilities for capturing and analysing company-wide data in real time and with a quality never seen before.

Next Steps

To learn more about how mobile data intake solutions can transform your risk and insurance programme, read our blog on the 7 Benefits of Mobile Data Intake in Risk and Insurance Management or contact Bjoern Heck.