The pandemic and advancing technologies have added increased impetus to the already explosive growth of digital transformation. As an example, the International Data Corporation (IDC) predicted that global spending on artificial intelligence (AI) would grow by nearly 20% this year.

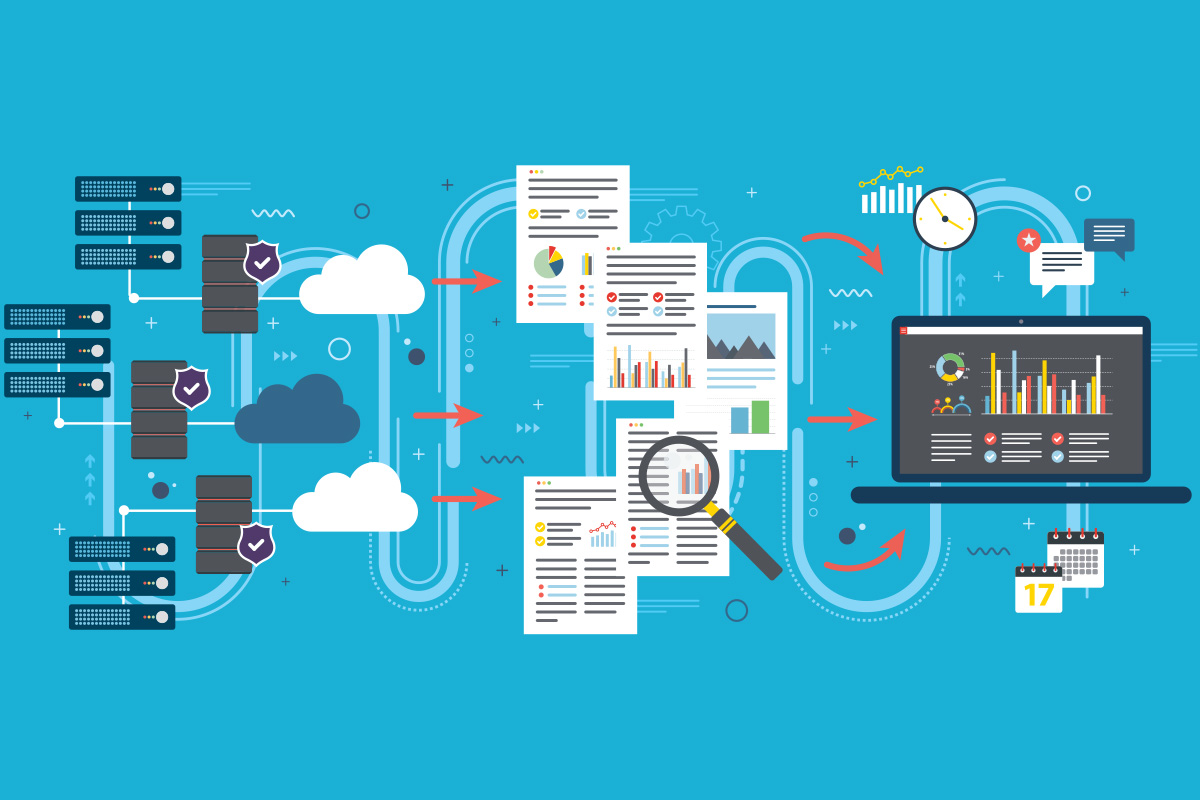

All aspects of the insurance industry are benefiting from digital transformation, streamlining everything from distribution to underwriting to pricing and claims. Lengthy, manual processes are being replaced by automation, and data collection and analysis combined with machine learning are providing actionable insights in real-time.

Thanks to the mountain of data it produces, a key benefit of digitalization for the insurance industry is predictive risk analysis. Predictive risk analysis is a form of advanced analytics using data mining techniques and machine learning to make future risk predictions based on historical data and statistical modeling. It finds patterns to identify risks and pinpoint opportunities. There are at least eight ways this benefits the insurance industry.

1. Actionable Insights for Insurance

The result of having new tools and techniques based on artificial intelligence, machine learning, data, and analytics is actionable intelligence. For example, data regarding driver behavior leads to the creation of tailored insurance plans, matching policies and premiums to customers. Accident data, such as braking, speed, and airbag deployment can now be used in ways never accessible before.

2. Process Automation

Process automation has changed traditional processes, particularly underwriting, claims, and customer service. Automation minimizes human error and makes processes more efficient and creates a better user experience. A specific type of automation is Robotic Process Automation (RPA). This is being used for repetitive tasks in the claims process, data entry, processing payments and claims, and so on. It also allows insurance companies to offer 24-hour service.

3. Cybersecurity

The risks of cybercrime have increased in parallel to the advances in digital transformation. The risks can be high for insurance companies because weaknesses in the traditional business models of insurance companies have resulted in multiple data platforms and siloed IT systems, which in turn create vulnerabilities. Advances in AI technologies such as predictive risk analysis have unified the cybersecurity posture across the various parts of insurance organizations.

4. Marketing Intelligence

AI and data analytic tools deliver true insights into customer behaviors, engagement, and needs. This takes the focus off products and processes and allows companies to focus on customers and marketing goals. The results of marketing intelligence can be seen in market segmentation, content generation, and behavior analytics.

5. Claims Processing

Automation and predictive analysis streamline insurance company services, for example, by settling claims quickly so customers are satisfied. Companies can collect better intelligence, automate processes, and initiate proactive engagement with policyholders. It removes bottlenecks and streamlines claims submission, prioritization, and triage, handling the high volumes of claims that are submitted after a catastrophic event.

6. Customer Experience

Customer transactions are traditionally divided into four types:

However, within those interactions, insurance companies need to account for and respond to ever-changing customer needs and demands. AI helps them to transition from traditional legacy systems to a more engaging and holistic customer experience.

7. Catastrophe Management

With an increase in climate events, the financial risk to insurers has increased exponentially. So the next frontier of AI and data analytic modeling has become catastrophe management, and it’s changing the way insurance companies provide quotes in areas where natural disasters are frequent. It’s also helping insurers respond to innovations that result in more complex building techniques and materials in the construction industry.

8. Pricing and Risk Selection

Switching insurance providers and policies is much easier now, given the rapid increase in online tools and sites for price comparing and quotes. The result is competitive pricing, but the danger is mispricing—since that would affect the bottom line for the company and brand loyalty among consumers. So it’s critical to get pricing right. Fortunately, AI technologies now have new data sources, such as social media and IoT devices that make analytics more accurate, and now traditional pricing methods are giving way to tailor-made pricing and products.

9. The People Paradigm

AI is driving huge advances in the insurance industry, but it doesn’t completely replace people. People have talents that AI cannot mimic, but talent shortages have become an obstacle for many HR departments. Training and integration are a big part of investing in new technologies.

To find out more about how AI and predictive risk analytics are changing the industry and revolutionizing the insurance business model, download and read the complete whitepaper, Brave New World—Artificial Intelligence, Analytics and Digital Integration.