Menu

- Products

- Our Solutions

- Advanced Analytics

- Billing

- Broker Portal

- Claims Management

- Core Claims Administration

- Cost Allocation & Calculation

- Data Governance

- Data Science

- Data Visualization

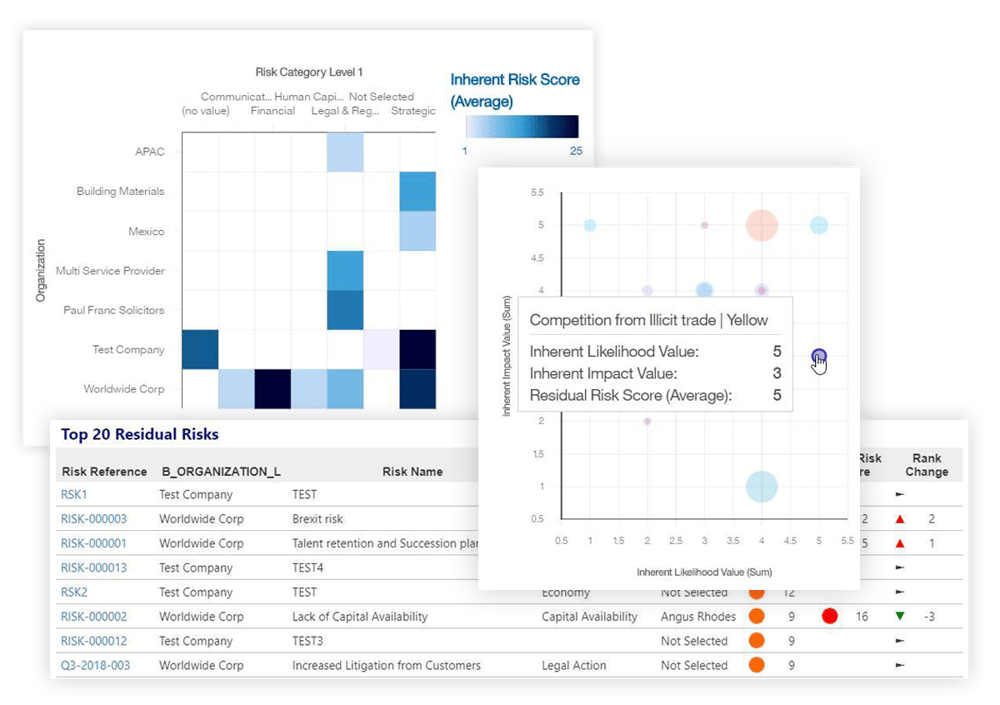

- Enterprise Risk Management

- Environment, Health & Safety

- Exposure Management

- Geospatial Analytics

- Hosting

- Incident Management

- Intake & Mobile

- Integrated Risk Management

- Legal Matter Management

- Medical Bill Processing Improvement

- Medical Professional Liability

- Patient Safety

- Policy & Program Management

- Predictive Analytics

- Renewal Management

- Risk Management Information

- Robotic Process Management

- Underwriting and Policy Issuance

- Your Needs

- Who We Are

- Resources